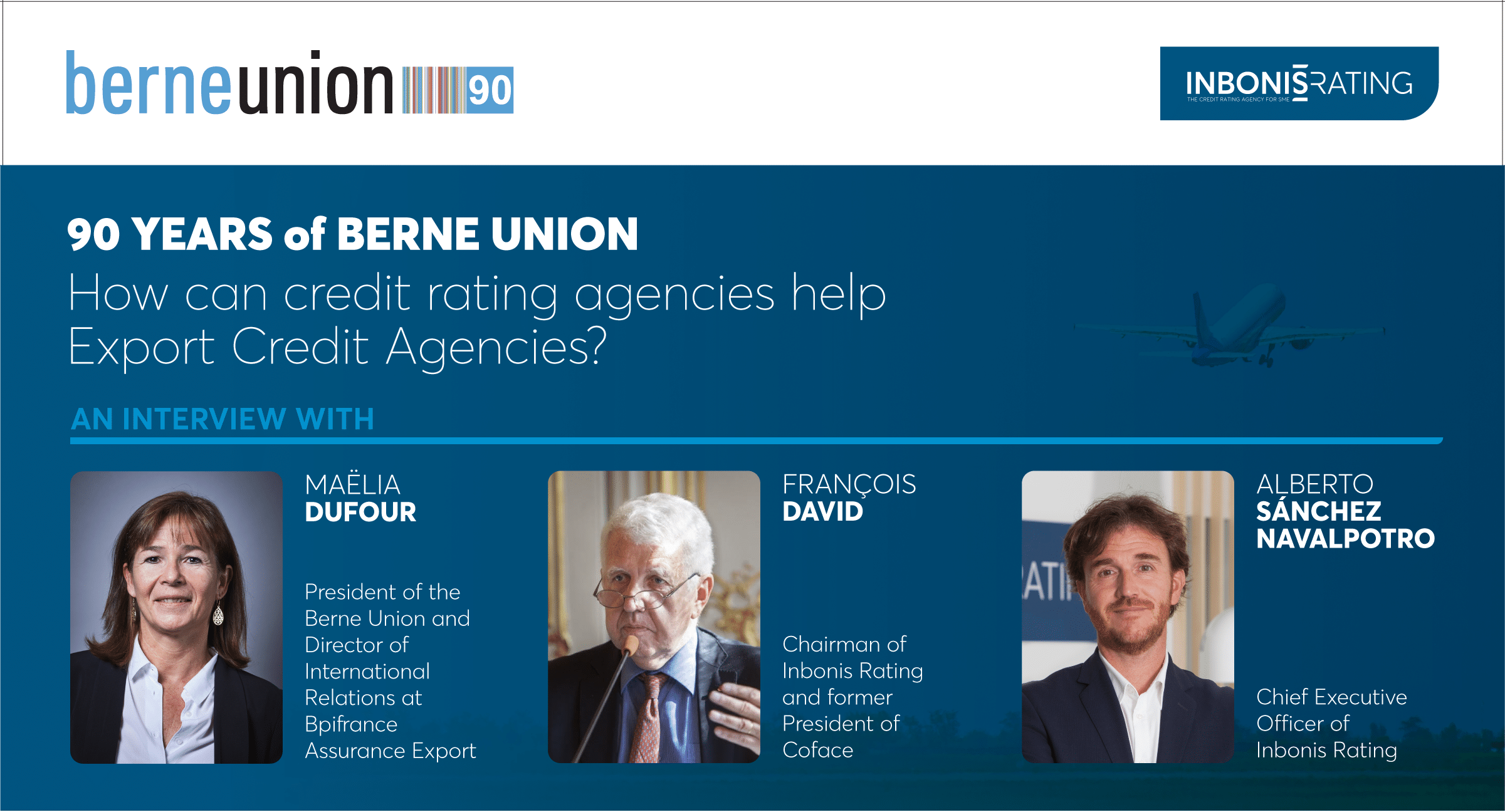

The 90th anniversary of the Berne Union is a unique opportunity to recall the role played by public, private and multilateral credit insurers, the ECA: these agencies are serving exporting companies and contribute directly to their growth and influence all over the world. In reality, however, securing these exchanges depends on a fair and accurate assessment of the global risk involved… and credit rating agencies can make an active contribution to this fundamental task. Here’s a look at the role of ECAs and the challenges they are facing, from the viewpoints of three key players: Maëlia Dufour, President of the Berne Union and Director of International Relations at Bpifrance Assurance Export, François David, Chairman of Inbonis Rating and former President of Coface, and Alberto Sanchez Navalpotro, Chief Executive Officer of Inbonis Rating.

- What is the role of ECAs and how do they actively contribute to business development?

François David: Export Credit Agencies are credit insurers: they provide a guarantee to an exporting company against the risk of non-payment by its buyer. The latter may default on payment for several reasons: political (e.g. nationalization or revolution) or financial (e.g. bankruptcy or financial crisis). In such cases, the exporter is reimbursed for his loan by the ECA. It is therefore essential for the exporter and the credit insurer to assess the financial solidity of the foreign customer. How can this risk be measured accurately? This is precisely the role of the credit insurer’s specialist teams, who use the information available and then carry out an in-depth investigation.

- Is access to quality information a challenge for the ECA industry and for the industry in general?

Maëlia Dufour: As far as large companies are concerned, recent, high-quality financial information is already available via rating agencies or on the websites of these companies, as they communicate regularly to be as transparent as possible. On the other hand, we often default to speculative grade ratings (below BBB-) for small and mid-sized companies, because they are generally highly exposed in terms of customer diversification, business volatility and financial strength. We have difficulty in finding recent, quality financial information for this type of company. The accounts available are sometimes more than two years old, whereas the financial health of this type of company can deteriorate rapidly. Knowledge of the local economic landscape is also very important. The quality of the group, the shareholders of the subsidiaries, the possible support of the parent company in the event of difficulties, and the payment experience of suppliers are also vital pieces of information that are not always accessible!

- In this context, what added value can a credit rating agency bring to ECAs?

François David: The major rating agencies provide very concrete information on country risk assessment, or complement analyses of large corporates: this can feed the work of ECA experts. However, to continue the discussion on smaller companies, I’m convinced that it would be very useful today for credit insurers to get closer to rating agencies for SMEs, whose methodologies are approved by ESMA and which go very far in their financial analysis of companies to compensate for the lack of directly available information. In practical terms, using specialized credit rating agencies can be a solution when the ECA does not have all the skills in-house, or when it wishes to improve and accelerate the evaluation process.

- Do agreements already exist between ECAs and rating agencies for SMEs?

Alberto Sánchez Navalpotro: Inbonis entered into a partnership with CESCE in 2023, which is a good illustration of this idea. This Spanish ECA contributes to the export of companies with many mandates from the State, but sometimes has insufficient resources to process them rapidly. CESCE carried out in-depth due diligence on our methodology before signing this agreement with us. This can be summed up as follows: if a company is already rated by Inbonis with at least a B notch, CESCE does not carry out a solvency analysis, and can focus solely on the transaction to decide whether or not to approve it. This streamlines their pipeline, enabling them to process more applications in less time. Rating agencies such as ours can also be a tool for providing quality information and enriching the information sources of ECAs in this segment, as is already the case with the coverage provided by rating agencies dealing with large corporates.

- What are the next challenges for the Berne Union? What are your medium-term objectives?

Maëlia Dufour: Climate is, of course, one of our top priorities: we now need to develop financial incentives for green projects, decarbonize our portfolios and establish climate strategies to move towards 0 carbon. Our second objective is to develop collaboration between members of the Berne Union, in particular between ECAs and private insurers, via reinsurance or with multilaterals. In addition, we are committed to raising the profile of young professionals, a major theme: this is the future, with both the transmission of knowledge from older experts and the acceleration of their active participation in discussions with their own perspective and knowledge of the challenges of new technologies such as artificial intelligence and digitalization tools. They are much more alert to these issues than the older generation. Finally, the subject of SME and ETI growth is of great interest to us, so much so that each year we dedicate a specific meeting to this theme: each member presents what he or she has been able to create that is new for this segment of companies.

- Why is export an important issue for SMEs?

Alberto Sánchez Navalpotro: Having been in contact with over 700 companies rated by our services in Europe, we’ve come to realize that the internationalization of SMEs and ETIs is more than ever a critical issue. Generally speaking, it is a factor in the resilience of this economic landscape. In times of crisis, the ability of SMEs in particular to export is a lifesaver, as was the case during the 2008 crisis. As a European rating agency, we can play a key role in supporting the commercial growth of these companies. The reality of SMEs is not reflected in structured data, which means that SMEs are often dismissed out of hand by export insurers. At Inbonis, we have developed a methodology that integrates intangibles in a structured way into the rating to reflect the reality of the SME or ETI as closely as possible. Thanks to this in-depth work, we aim to enable these companies to accelerate their international exchanges. This is a major issue, because our European economies depend on their health.

INBONIS Rating

INBONIS Rating is the first credit rating agency specialising in SMEs and mid-caps registered and supervised by the European Securities and Markets Authority (ESMA). In Europe, only rating agencies accredited by ESMA can issue ratings. This accreditation allows the agency to issue rating notes on SMEs and mid-caps in any sector within the European Union.