INBONIS helps financial institutions and corporations to improve their business with SME, providing technological solutions to resolve the problem of accurate and efficient credit risk assessment.

Advanced Model Calibration

Provides its proven algorithms and capabilities in the development and calibration of advanced SME credit risk models to leading financial institutions, adapted to the circumstances of each market.

AROA

Machine learning algorithm that uses natural language processing (NLP) to extract the reputational sentiment of any given SME present in local press. It is offered as a service to financial institutions.

Download brochure

PDF - 113 KB

Download brochure

PDF - 113 KB

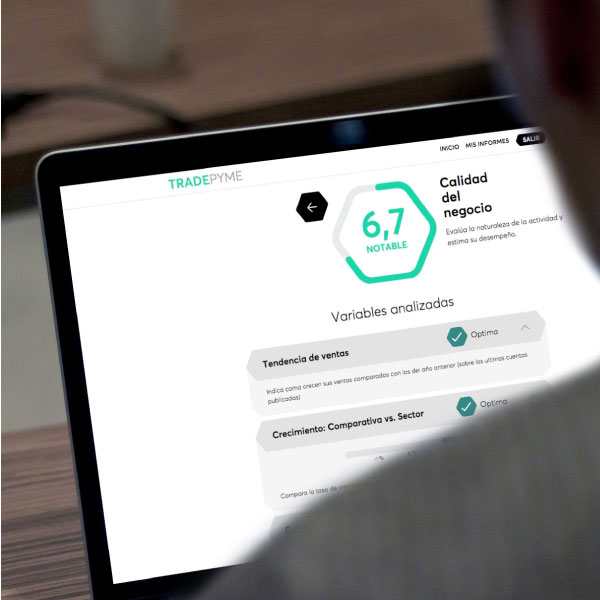

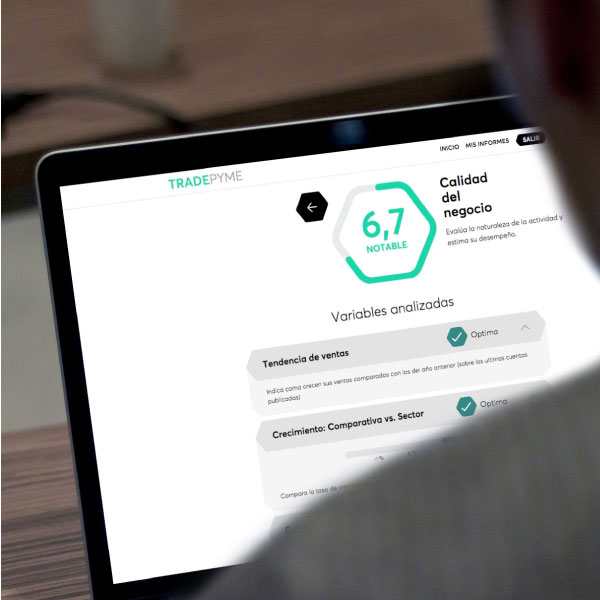

TRADESME

Digital solution distributed in white label, which allows an automatic and instant appraisal of a given SME, It aggregates public data and collects qualitative opinions. It can be offered to SME directly or to commercial teams as it enables to include risk criteria in commercial actions. Currently available in France and Spain.

Download brochure

PDF - 413 KB

Download brochure

PDF - 413 KB

COACHSME

Digital financial education application that allows microenterprises to understand their financial statements in several clicks. It is distributed in white label to organizations committed to improving the local business fabric. It is currently offered in France and Spain.

Download brochure

PDF - 135 KB

Download brochure

PDF - 135 KB